Insurance Payment Reconciliation

Use these tips and notes to effectively manage Electronic Remittance Advice (ERA) reconciliation for claims and bank statements in Lightning Step.

Why ERA Reconciliation Matters

-

Matching ERAs to both claims and bank statements ensures payments are accurate and complete.

-

Reconciliation quickly identifies missing payments, underpayments, or discrepancies.

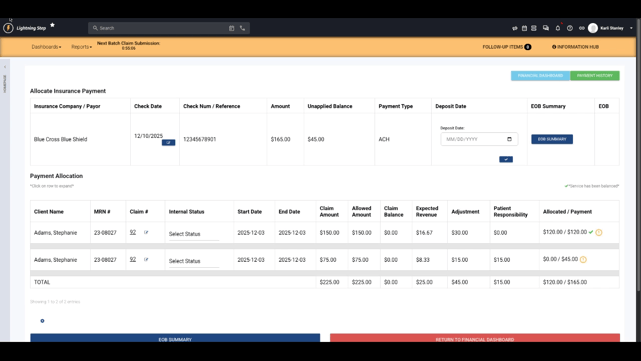

Automated Matching and Posting

-

When you load an ERA, Lightning Step matches payments to claims automatically.

-

After posting a payment, check for any remaining or negative balance—these could signal overpayments or over-adjustments.

-

Confirm each claim’s remaining balance is $0 before considering posting complete.

-

Review the unallocated or unapplied amount at the top of the ERA screen; if above zero, further review is needed.

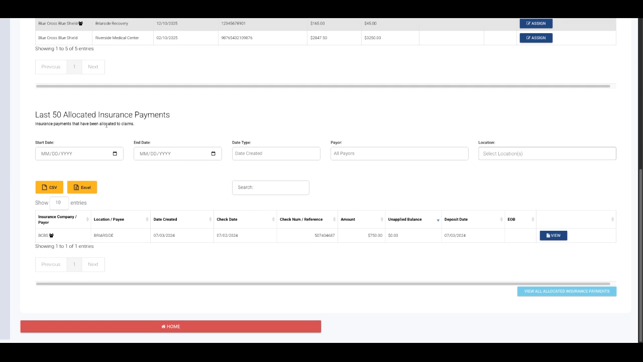

Allocated Payments and Review

-

Fully posted checks move to the allocated payments section, making tracked records easy to review.

-

Focus your attention on any records that haven't moved to allocated payments—they require follow-up.

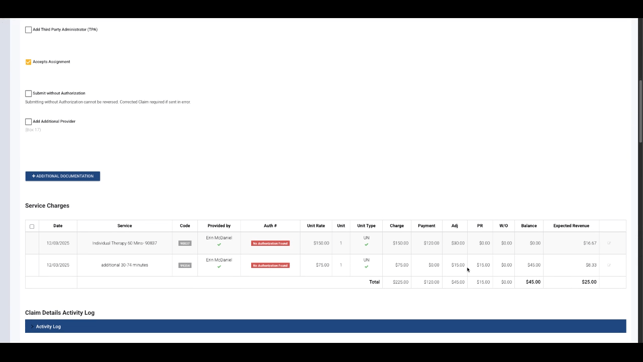

Claim-Level Reconciliation

-

Each claim displays reconciliation details, such as: billed amount, payment, adjustments, patient responsibility, and any remaining balance.

-

Use these details to spot claims needing attention—any balance left means follow-up is required.

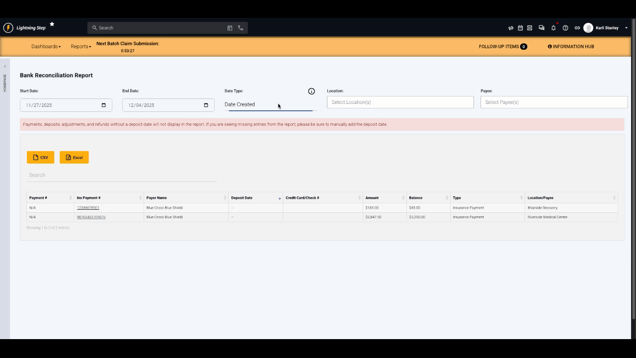

Higher-Level Reconciliation Tools

-

Use the bank reconciliation report to review all payments by posting date or, preferably, deposit date.

-

Match Lightning Step’s deposit dates with your bank statement for accuracy.

-

The report covers both insurance and patient payments—use the type column to distinguish between them.

Troubleshooting & Best Practices

-

A check with an unapplied or unallocated balance requires research before it can be considered reconciled.

-

Always review and reconcile at both the claim and bank statement levels for a full audit trail.

-

Use internal documentation or reach out to support with specific questions or for more details.

ERA reconciliation helps you catch and correct discrepancies quickly, so payments and records stay accurate and auditable.